Search by Location

|

Search by Drive Time™

search near me

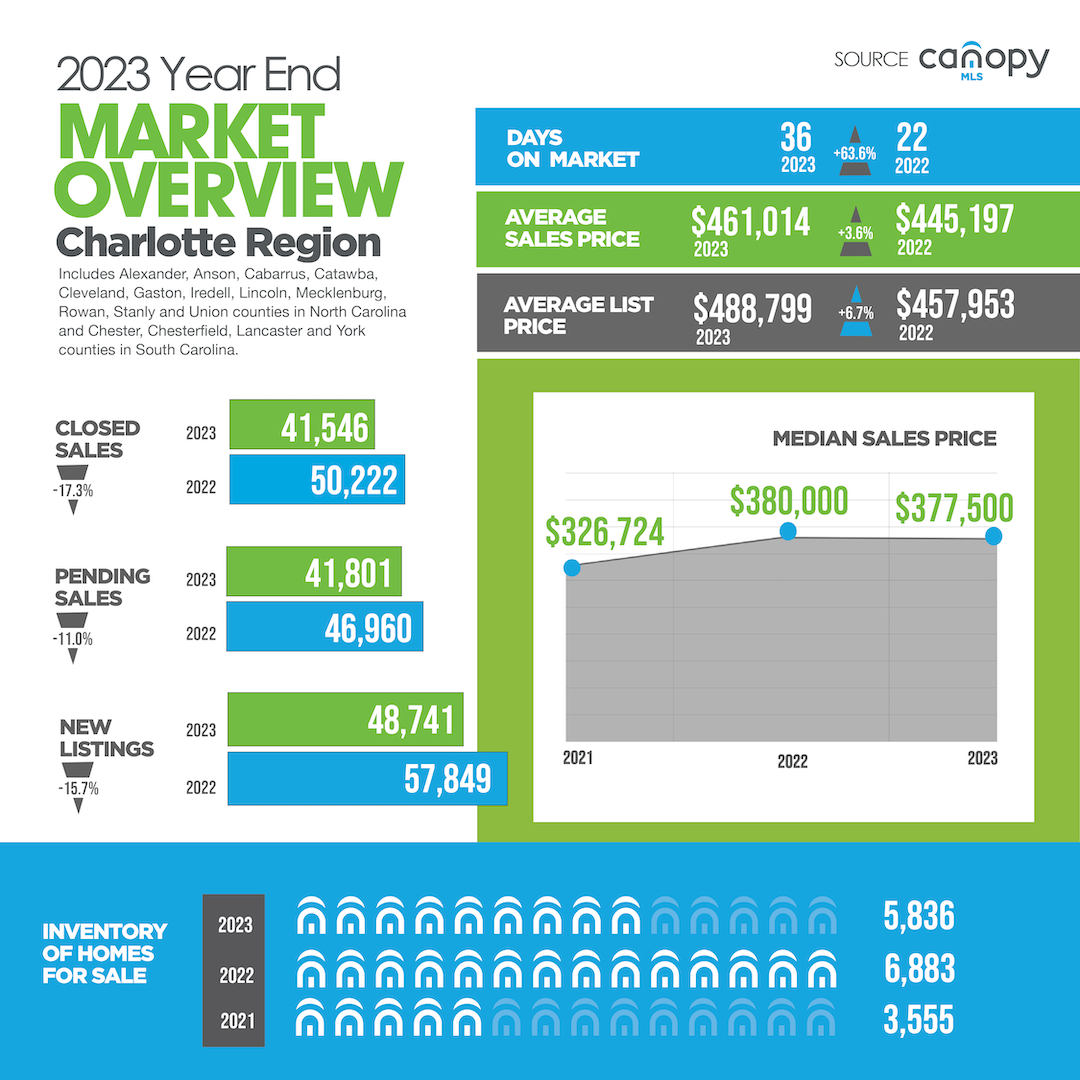

As we are well into the new year, let's look at a comprehensive overview of the Charlotte housing market at the close of 2023 and a glimpse into what lies ahead in 2024. I discuss mortgage trends, buyer and seller dynamics, and the factors shaping the real estate landscape in Charlotte. Whether you're a homeowner, a potential buyer, or simply curious about the state of our local market, I am here to help navigate the world of real estate with confidence and clarity. Let's dive into the details.

Let's talk about mortgage rates! Good news—experts predict a positive shift in home sales this year. Mortgages are expected to become even more helpful in 2024. We've seen how these rates can affect buyers, and with rates around 6% right now, things are looking good.

In December 2023, mortgage rates averaged 6.61%, making it a bit easier for people to own homes. As of mid-January 2024, rates are still looking decent:

• 30-year fixed = 7.51%

• 15-year fixed = 6.54%

• 10/6 ARM = 7.71%

Sales at the end of 2023 were down by 17% compared to the year before, but there's a bright side. Contract and new listing activities increased in December, showing that the decreasing mortgage rates positively affected buyers making the decision to purchase.

Buyer demand was down by 11%in 2023, but the outlook for 2024 depends on rates, inventory, and supply. If rates stay around 6%, there might be more competition and home prices could go up if supply stays tight. Seller confidence, which is shown by new listing activity, has been a bit low since 2020. Sellers were cautious during the pandemic, and rising rates in 2022 and 2023 made them even more careful. However, both buyers and sellers are becoming more active as rates have dropped since October when they were at their highest.

Rates in 2024 are expected to be between 6.3% and 6.8%, according to experts. Prices softened a bit in 2023 but there was still positive appreciation for homeowners. This softening trend might continue in 2024, but don't expect prices to drop a lot, more likely we will see slower price appreciation.

2024 might bring some challenges, but here's the scoop:

• Buyers may face less competition, making it a great time to look for homes.

• Inventory is a bit of a challenge, especially for first-time buyers, but home appreciation is going up so waiting does not mean it will cost you less.

• Homeowners, you're in a good position! Home appreciation has gone up by 5% over the region, and many homeowners have gained over $100,000 in housing wealth over the past three years! $100,000!!!! In three years.

• The typical homeowner has $396,200 in wealth versus $10,400 for renters, according to the Federal Reserve.

In short, rates should improve, demand will go up, prices may soften a bit, and inventory will slowly increase. We're not expecting big changes, but the housing market is moving in a positive direction.

For more details, you can check out the full reports from

See also: